|

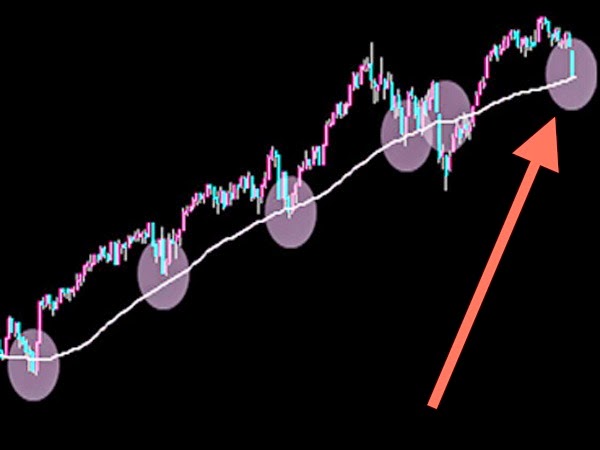

| Today's Pre Market | 17 NOV 2014 | Market Startup | Market Trend |

Market out

looks....

Trend are

good and positive mode......

As long as

Nifty hold 8290 in spot basis. there is no problem

in bull

market and ultimate target are 8600-8700 in the month of novemember and 9000 in

next one or two months.

Bank

Nifty....

also looking

hot with consider support are 17200-17000 range, as long as hold this level we

expect to test 18000 in the month of November.... Over all trend are bullish

and E Wave target forcast nearly 23000 + in coming months.

IT stocks

also looks good and break in IT Index resulted

buying

opportunity in TCS, HCL Tech, Infosys, Wipro, Hexaware etc.

Steel stocks

some consolidation mood but Tata Steel given a break out so buy side...

Pharma ....stocks

time for consolidation. Biocon likely under perofrm in this sector...

Reality

Index......Ready for break out.... HDIL, IBREAl Prestige Estate and Sobha

Developers are good and any decline to buy side. DLF, UNITECH to avoid at

current lvel.

Capital

Goods......LT likely ready to move but BHEL some weakness liekly.

Telecome

stocks...Play for market leader like Bharti.... consider decent support 380

mark.....and ready to verge of break out, thereafter sharp move 15-20 points

easily.

Coal India....up

move continue but real stregnth show above 372.

More up

dated wait.

Commodity

Market up dated....

Gold and

Silver last trading on Friday sharply move were saw and almost last three

months closed with highest gained due to depreciation of rupee and weakness in

Dollar buying were saw in the precious market.

However,

trend are down, some steams are still left, thereafter it will come down again

in northward journey..... So be cautious at higher level.

Gold.....Week

to week gained almost 1100 points and closed at 26466. We may consider

resistance 26750-26800 and support are 26000....below sell side.....

Keep a stop

loss....and sell for target 25500 in near term.

Silver....Short

term trend up once it was break out above 35000 and finally made a high 36266

and managed to closed at 36000 mark. Trend are down and sell on rise strategy.

We may

consider selling point around.................and sell with stop

loss...........for tqarget 2000 + points in near term....

Copper....Trading

continue and we can expected sooner or later it will break out.....with

consider support 395-390 and resistance 420.....Trend is down and sell

side......

Crude.......Weakness

continue and very near to long term support ...once break down this support

.....expected it will come down below 4000 mark easily in few sessions.....

However, RSI

showing highly oversold zone so at the current level shorting is not a good

idea......keep a patience and wait for rise and sell side for 300 to 400 points

from the higher level.

Natural

Gas......Selling pressure continue it was broken support level 270 mark...Now

we may consider resistance 260-262 range and support 240 range...

.....................................................................................................

TODAY’S COMMODITY MARKET | 17 NOV 2014

TODAY’S STOCK MARKET | 17 NOV 2014.

.....................................................................................................

If you

want to make money in BEAR/BULL market- join our team

Visit

: www.3mteam.in or call at 9317304732

Email

: enquiry@3mteam.in

No comments:

Post a Comment